The Ultimate Guide to Bookkeeping for Small Businesses

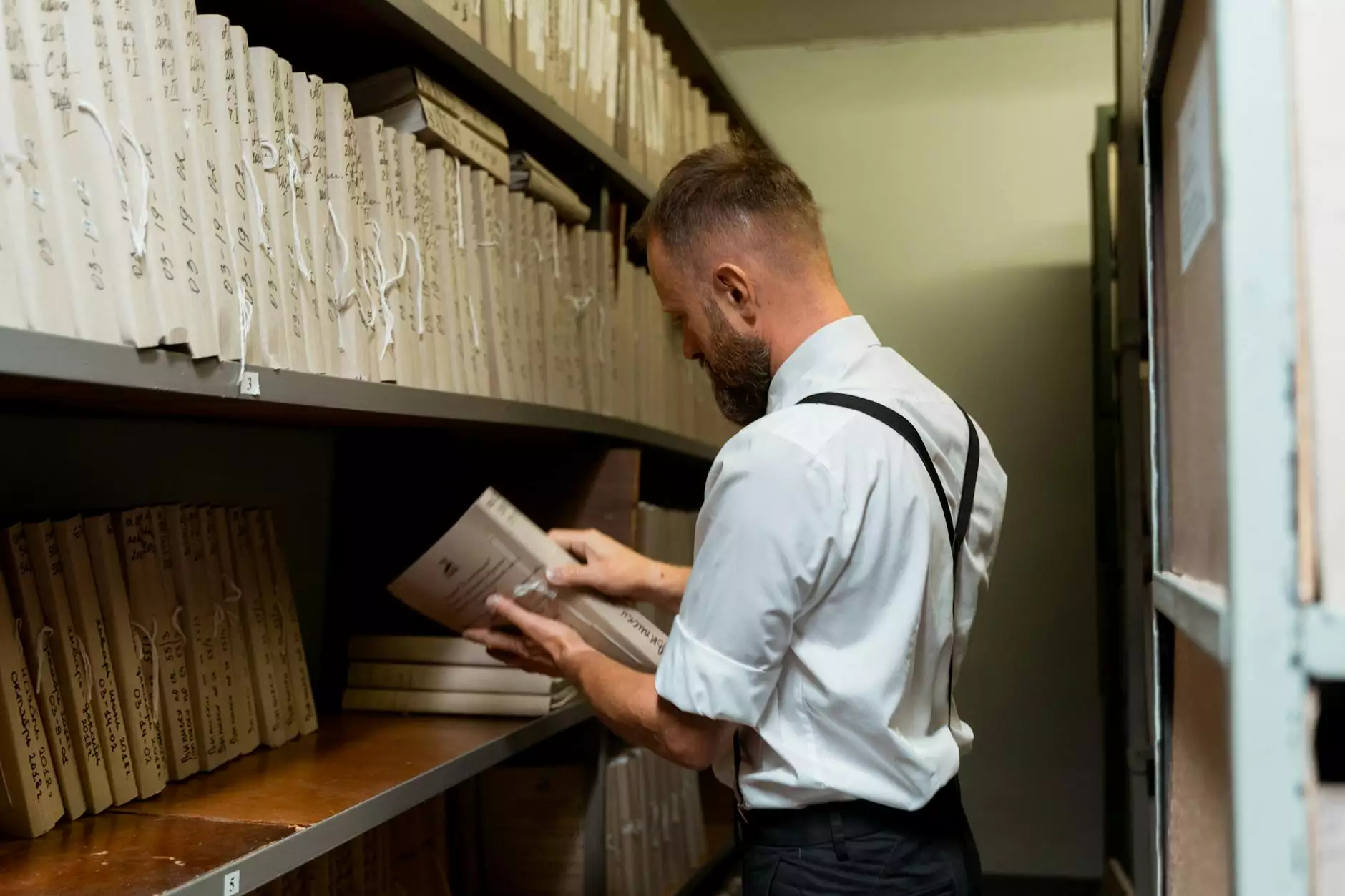

Bookkeeping is the backbone of any successful small business. It involves recording, tracking, and managing financial transactions to ensure your business runs smoothly and stays compliant with financial regulations. In this comprehensive guide, we will explore the significance of bookkeeping for small businesses, the best practices to implement, and the tools you can utilize to streamline the process. By the end of this article, you will have a clearer understanding of how to maintain accurate financial records and boost your business's viability.

Understanding Bookkeeping for Small Businesses

Small businesses often operate with limited resources, which makes it crucial to manage finances effectively. Bookkeeping is more than just data entry; it is about maintaining a clear and organized financial record that provides insights into the business's financial health.

What is Bookkeeping?

Bookkeeping involves the systematic recording of financial transactions such as sales, purchases, income, and payments. It is an essential part of financial management, helping business owners understand their cash flow and make informed decisions.

The Importance of Bookkeeping for Small Businesses

- Financial Clarity: Accurate bookkeeping provides clarity about your business's financial status, helping you understand where your money is going.

- Tax Compliance: Proper records ensure that your business meets tax requirements, minimizing the risk of audits and penalties.

- Informed Decision-Making: With precise data, business owners can make better decisions that foster growth and stability.

- Improved Cash Flow Management: Bookkeeping helps you keep track of receivables and payables, ensuring healthy cash flow.

Key Bookkeeping Practices for Small Businesses

To maintain effective bookkeeping, small businesses should adopt several key practices.

1. Choose the Right Bookkeeping Method

There are two primary methods of bookkeeping:

- Single-entry bookkeeping: This method is suitable for smaller businesses with less complex transactions. It involves recording each financial transaction only once.

- Double-entry bookkeeping: This method is more comprehensive and suitable for businesses seeking in-depth financial analysis. It records each transaction twice, once as a credit and once as a debit.

2. Keep Personal and Business Finances Separate

One of the most critical aspects of bookkeeping for small businesses is to keep personal and business finances separate. This practice simplifies bookkeeping and helps prevent potential legal issues when it comes to taxes and liability.

3. Use Accounting Software

Investing in reliable accounting software can make a significant difference in your bookkeeping efficiency. Popular options such as QuickBooks, Xero, and FreshBooks offer robust functionalities that assist small business owners in managing their finances effortlessly.

4. Regular Reconciliation

Regularly reconciling bank statements with your financial records is essential. This practice ensures accuracy and helps identify discrepancies early on, which can prevent bigger issues down the line.

Essential Tools for Bookkeeping

Technology has revolutionized the way small businesses handle bookkeeping. Here are some essential tools that can streamline your bookkeeping processes:

1. Accounting Software

As mentioned earlier, accounting software is vital. Look for features that suit your business needs, such as invoicing, expense tracking, and financial reporting.

2. Receipt Scanner Apps

Receipt scanning apps can simplify expense tracking. By scanning and categorizing receipts digitally, you can reduce clutter and ensure you have records for tax purposes.

3. Financial Dashboards

Financial dashboards provide real-time insights into your business finances. Tools like Tableau or Google Data Studio can help you visualize your financial data effectively.

4. Payroll Software

If you have employees, investing in payroll software will ease the burden of managing payroll calculations and compliance.

Common Bookkeeping Mistakes to Avoid

Even seasoned business owners can fall prey to bookkeeping mistakes. Below are common errors to avoid:

- Neglecting Documentation: Always keep receipts and invoices as they are essential for accounting and tax purposes.

- Infrequent Record-Keeping: Regular updating of financial records is crucial. Set aside a specific time weekly or monthly for bookkeeping.

- Overlooking Financial Reports: Regularly review your financial reports to monitor performance and rectify any anomalies.

- Ignoring Professional Help: If bookkeeping becomes overwhelming, consider hiring a professional accountant or bookkeeper.

The Role of Professional Accountants in Small Business Bookkeeping

While many small business owners opt to handle bookkeeping themselves, enlisting professional accountants can provide substantial benefits.

Benefits of Hiring an Accountant

- Expertise: Accountants have specialized knowledge that can aid in efficient bookkeeping practices.

- Time-Saving: Outsourcing bookkeeping frees up valuable time, allowing you to focus on growing your business.

- Financial Guidance: Accountants can offer strategic advice that can improve your overall financial strategy.

- Stress Reduction: Knowing professionals are managing your bookkeeping can significantly reduce stress and worry.

Conclusion

Effective bookkeeping is vital to the success of any small business. It ensures accurate financial reporting, helps in tax compliance, and enables informed decision-making. By adopting best practices, utilizing technology, and potentially seeking professional help, you can create a solid financial foundation for your business.

At booksla.com, we specialize in providing financial services, financial advising, and accounting solutions tailored for small businesses. Prioritizing careful bookkeeping can set your business on a path toward greater profitability and sustainability. Start investing in your bookkeeping practices today and discover the difference it can make for your business's future!

book keeping small business